Intax Presents

Budget 2021

OVERVIEW

Budget 2021 was announced on Tuesday, 13 October 2020.

This document sets out the main changes in taxation, social welfare, health, housing, education, employment and other areas.

It is an overview and not a complete statement of the measures announced in Budget 2021.

There might be updations to the budget in the future.

Some of the changes announced in the Budget come into effect immediately. Others take effect from the beginning of January 2021 or later in 2021. Many others have to be finalised before coming into effect.

Some elements of these measures may change when the legislation required to bring them into effect is enacted.

LOOKING TO FILE YOUR TAX RETURN/ FORM 11?

Appy now to www.taxreturned.ie & Get a FREE Tax Assessment

Apply Now

Help to Buy Incentive Extended

The Help to Buy incentive is a scheme for first-time home buyers. Budget 2021 extends the scheme to December 2021 in recognition of the fact that the property market is impacted by COVID-related delays. The rate of the scheme was increased as part of the July Jobs Stimulus package and offers first-time buyers a tax rebate of up to €30,000, compared to the previous rebate of up to €20,000.

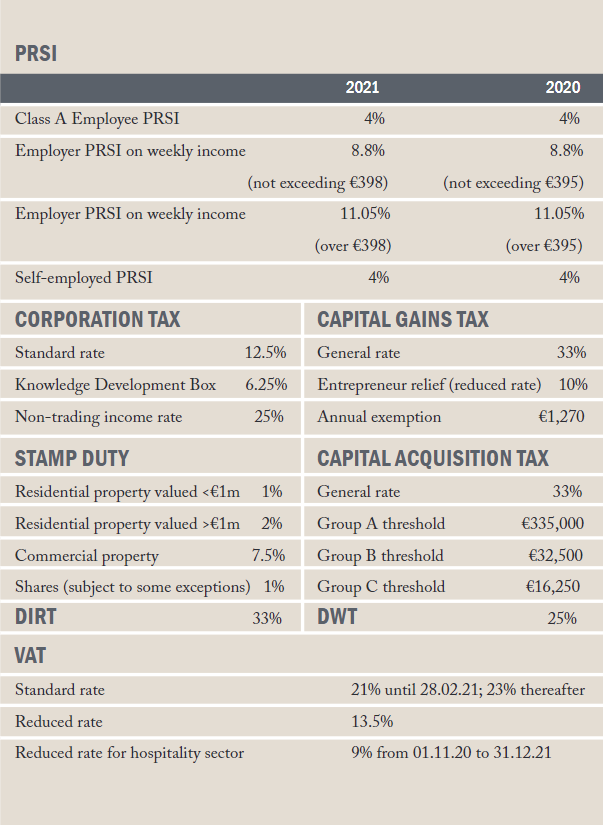

Residential Development (Stamp Duty) Refund Scheme

This scheme provides for the refunding of a portion of the stamp duty paid on the acquisition of non-residential land where that land is subsequently developed for residential purposes, so bringing the effective stamp duty rate down to a minimum of 2%. It was due to expire for new applications on 31 December 2021, but this deadline is now being extended to 31 December 2022. Furthermore, the 24 months currently allowed between commencement and completion of construction is being extended to 30 months, meaning that the last possible eligible completion date will be 30 June 2025.

COVID Restrictions Support Scheme

A new COVID Restrictions Support Scheme (CRSS) has been introduced. It is aimed at businesses that have either been prohibited from operating or have only been able to trade at significantly reduced levels as a result of restrictions imposed on them in response to COVID-19.

Qualifying businesses can apply to Revenue for a cash payment, representing an advance credit for trading expenses that are deductible for income and/or corporation tax purposes (ACTE). The scheme will be effective from 13 October 2020 until 31 March 2021 and the first payments will be made by mid-November. Payments will automatically cease at the end of the COVID-19 restriction period.

Payments will be calculated on the basis of 10% of the first €1 million in turnover and 5% thereafter, based on average VAT exclusive turnover for 2019, and will be subject to a maximum weekly payment of €5,000.

The Scheme will generally apply when Level 3 or higher restrictions are imposed in line with Resilience and Recovery 2020-2021: Plan for Living with COVID-19. It will run from Budget day until 31 March 2021, and be brought into effect by Finance Bill 2020.

Corporation Tax Measures

Rules for capital allowances on intangible assets are amended to provide that all assets acquired from Budget night will be fully within the scope of balancing charge rules.

The Accelerated Capital Allowance (ACA) scheme allows a deduction of the full cost of expenditure on eligible energy efficient equipment from taxable profits in the year of purchase and is extended until 31 December 2023.

The Knowledge Development Boxwill be extended in Finance Bill 2020 for a further two years until 31 December 2022.